Keeping you VAT compliant in China and one step ahead

VAT Digital

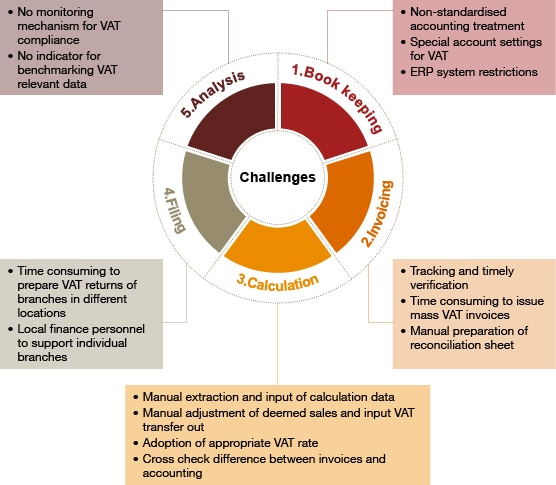

Tax functions often spend a significant amount of time gathering data as well as completing filings. From our experience, we often see clients have disjointed solutions with heavy reliance on multiple spreadsheets, and overlooked early warning signs of risks. All these may hinder their ability to contribute more strategically to enterprise-wide decisions. As a result, companies may face with the following challenges at different stages of a VAT cycle:

Staying ahead of the game – from spreadsheet to technology-driven forecasting

Developed specially for our clients with market presence in China, VAT Digital will support you throughout the VAT return process with the following advantages:

- Free up your time to analyse and plan – VAT Digital allows you to better focus your resources on analysing data and creating strategies to generate revenue and cut costs, rather than spending valuable time gathering data.

- Automate calculation – Surpass your spreadsheet capabilities, VAT Digital can reconcile transactions for you and automatically prepare the VAT return.

- Data analytics - We turn data into insights.

- Using diverse data analysis and modelling, VAT Digital will produce indicators and provide you with an overview of your current VAT status.

- Discover inefficiency and potential compliance risks by enhancing the traceability of data source and worksheets.