Managing entities locally with a global perspective

With changing regulations, managing entities locally and globally is becoming challenging. A consistent and transparent approach in managing entities can help corporations pro-actively manage the life-cycle of their legal entity structure more efficiently. Our experienced professionals are committed to providing you with pragmatic and unique insights to respond to your business needs in different areas and in different jurisdictions.

Directors’ training to maintain good corporate governance standards

Regulators worldwide have committed to enhance their corporate governance standards for listed companies, in order to maintain public investors’ confidence in the stock market. Our service in providing directors’ trainings can help the board of directors of listed companies to keep abreast of directors’ duties and responsibilities and the latest development on regulatory requirements and corporate governance practices.

Realising your performance potential

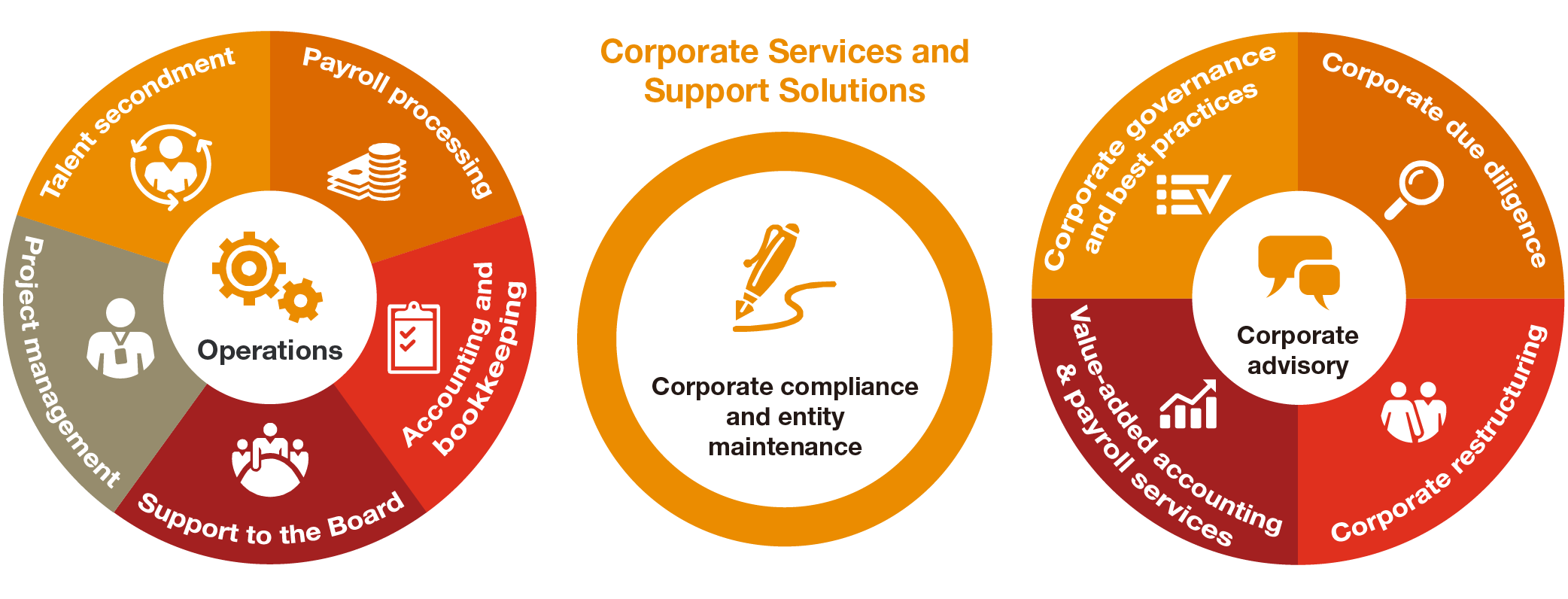

Some organisations have alarmingly found themselves diverting more resources from their core business in order to stay compliant in increasingly complex environments and cope with growing operational needs. To help you stay focused on your core activities and achieve your business performance goals, we collaborate with our Accounting and Payroll professionals to lower your compliance risk, increase operational efficiency and reduce cost in hiring in-house specialised staff. Please click below for further details of corporate services.

Contact us