Streamlining the China corporate income tax filing processes

Copy link

Link copied to clipboard

CIT Digital

With the rapidly changing and increasingly transparent global environment, tax functions need to understand the benefits of using technology to automate tax processes and workflow and improve data quality and analytical capability.

Supporting you with a new approach and enhanced value

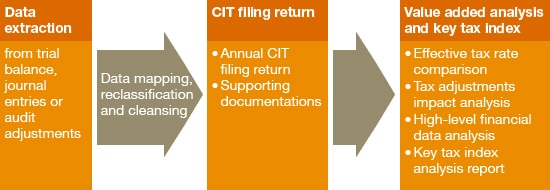

To remain relevant to the business, CIT Digital helps you build a compelling and cost effective business case for change. By leveraging the strength of technology and our experience working with clients, CIT Digital can streamline and automate your annual corporate income tax (“CIT”) filing process. It gives you better control over tax data so you are able to free up time for other value-added activities.

How is it different from the traditional CIT filing?

- More compatible and flexible data collection method

- More complete and accurate: Data collected with greater traceability (down to journal entries level)

- More comprehensive: Provide you with key tax index and allow comparison with previous year’s data

- More efficient: Streamlined communications by leveraging the audit team’s work and detailed data collected

Follow us