Redesign, redefine and redeploy the tax function to be a strategic business asset

In a fast changing world, we’re helping clients build a tax function for the future. Our complete approach to tax management brings together tax function design, technology and compliance delivery. By aligning your tax and tax technology strategies with your commercial goals, the tax function will become a strategic business asset, adding value across the organisation.

Understanding your organisation’s challenges, goals and needs is just the start. Successful change will require re-engineering 'end-to-end' processes not just the final outputs.

I want to:

- Reduce the cost of delivery

- Accelerate the impact of technology in delivering my tax needs

- Reflect business and technology changes in my tax operating model

- Have confidence and certainty over compliance

- Have an efficient and effective tax reporting process

- Manage tax risk and implement robust tax governance to increase transparency and trust

- Understand and be prepared for changes in the strategy and requirements of tax administrations and regulators

- Leverage finance transformation for tax

- Improve and automate tax processes

- Have robust and accurate data for the business and tax administrations

- Unlock data insights to add more value to the business

- Align tax with business strategy

Reduce the cost of delivery

The tax function is under constant pressure to deliver more with less. Internal cost pressures and the demand for greater business insights against the backdrop of meeting increasing tax compliance demands in shorter time frames is resulting in the need for tax functions to chart a course of continuous improvement making the most of the latest technology developments.

With the focus global tax authorities are placing on clients to manage tax risk it’s essential to deliver efficiencies while ensuring the overall control environment is effective. Our approach to this issue is to look holistically at the building blocks that make up a tax function and develop a change roadmap that brings together these components in a coherent manner.

Tax Function of the Future: What KPIs are driving the Tax function today

How should success be measured? We will explore established, as well as new, innovative key performance indicators (KPIs) that organisations can use to evaluate how well the Tax function is performing in today’s environment.

Accelerate the impact of technology in delivering my tax needs

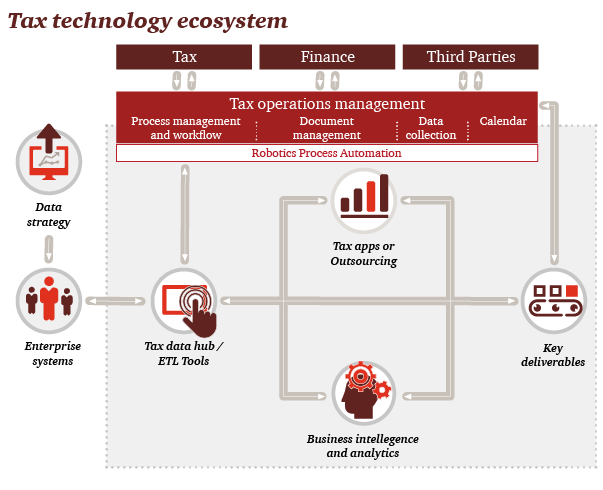

Technology is driving and enabling change throughout business. Whether through the improvement of data quality or the automation of processes, technology is at the forefront of transforming the Tax function into an efficient business enabler.

The modern Tax function will have a defined technology strategy which will be aligned with related parts of the business. The Tax function can then integrate technology into their overall strategy with a clear roadmap for delivery either by implementing new technology or leveraging existing technology.

We can support you on this journey to ensure that you’re not left behind.

Learn more on our Hong Kong tax technology website.

Reflect business and technology changes in my tax operating model

A Tax function’s ability to deliver value depends on how well it’s able to adjust to today’s ever evolving regulatory changes, while supporting the company’s business strategy. Too many corporate Tax functions are struggling to address operational ineffectiveness, or may have been impacted by a recent merger or acquisition, and senior executives are taking notice.

Forward-thinking tax departments are conducting thorough current-state assessments that provide a road map of specific actions, cost, and relative priorities for the tax function to consider improving efficiency. These assessments take into account the current operational state, culture, and realistic appetite for change and are often scaleable.

We can provide flexible, but thorough, solutions to help improve your Tax function’s performance while reducing your risk.

Spotlight: Tax operating models - Technology disruption in sourcing decisions

In this third spotlight publication, we focus on various operating models that are available to enhance the Tax function from a sourcing perspective.

Have confidence and certainty over compliance

Many companies are rethinking their approach to domestic and global compliance and reporting by taking a closer look at their technology, processes, resources, and service providers. Leading tax functions are using co-sourcing/outsourcing as a critical component of Tax function strategy, and as a means to better align Tax function investments and use of talent with organisational goals.

Our approach:

- We can work with you to coordinate all the tax compliance activities (e.g. direct and indirect taxes, tax accounting, preparation of statutory financial statements and country by country reporting) for your subsidiaries, with diverse accounting practices, legislative environments and business customs, seamlessly and cost-effectively

- Local country specialist teams form the backbone of our service offering, providing experienced resources to help with the compliance needs today, support in future audits, and practical knowledge of current and emerging regulatory requirements

- Our client relationship managers deliver centralised coordination and communication

- Our experience and scalability allows us to customise and adapt our delivery model to align with your broader business goals

Have an efficient and effective tax reporting process

Financial restatements, coupled with increased regulatory scrutiny of tax accounts and related tax disclosures, have elevated the focus on tax accounting and exposed significant problems in many companies.

Changes to tax laws, GAAP convergence and new accounting standards have become a growing challenge for multinationals, many of whom are rapidly expanding their geographic footprint.

We can help you develop fit for purpose and well managed tax accounting processes.

Our team of dedicated technical specialists around the globe provide guidance, and best practices, on a range of tax accounting issues, including:

- Tax provision outsourcing and support

- Accounting for uncertain tax positions (including FIN 48) assessments

- GAAP conversion modelling to determine the tax and accounting impact of moving to a different GAAP

- Other specialised tax accounting services, including deferred tax analyses and tax basis balance sheet assistance

- Tax accounting technical assistance and support, including customised training

Tax Function of the Future: Driving value through tax reporting

In this publication we turn our attention to enhancing the financial statement tax provision and tax return compliance processes (collectively, ‘tax reporting’ processes).

Manage tax risk and implement robust tax governance to increase transparency and trust

Tax authorities and other stakeholders expect Tax functions to be able to demonstrate, with evidence, that they have operated in an effective and efficient way. They must be able to show, often via a formalised tax control framework and testing programme, that tax risk is mitigated to an acceptable level and tax opportunities have been taken in line with the organisation’s overall attitude to reputational and compliance risk.

Increasingly managing tax is not a purely technical challenge and the skills required also include technology awareness, project management, leadership, and communication with the wider business in a way that they understand.

We can work with you to:

- Perform a current state review of tax management across your business using our Tax Management Maturity Model (T3M)

- Develop a tax strategy that's aligned to your organisation’s commercial goals

- Develop and implement a detailed roadmap for transformation

- Improve the effectiveness and efficiency of your processes and controls

- Undertake detailed risk management reviews

- Identify and manage the risks and challenges arising from change

- Meet the demands for increased transparency

Understand and be prepared for changes in the strategy and requirements of tax administrations and regulators

A key challenge for companies in the current environment is to consider how best to respond to a landscape which continues to evolve. Increased attention from stakeholders around tax is driven by a number of factors including media headlines, pressure from campaign groups and the public, and changes in regulation (e.g. country-by-country reporting). Some companies are adopting a reactive approach while others are being more strategic, considering transparency, to whom and for what purpose.

We can help you to develop your thinking in this area.

Leverage finance transformation for tax

Finance transformations represent risk and opportunities for tax functions. Generally there are two types: organisational change and finance system change. Either of these generic change programmes will impact on the Tax function's ability to continue to remain tax compliant, as inevitably the data, systems and processes which tax rely on to deliver tax compliance and reporting will be impacted.

We can support Tax functions to fully engage with the finance transformation and position itself as a primary customer of the finance transformation programme.

Tax Function of the Future: Tax as a critical component in every Finance transformation

This fourth article in the series explains why it is critical for Tax to be an integral part of Finance transformation initiatives from the outset.

Improve and automate tax processes

Core processes and routine activities can have a significant and lasting impact on the Tax function. As tax laws and accounting standards continue to evolve, Tax is challenged to look closely at how data and related documents are received, processed, and ultimately retained, while continuing to add value through strategic decision making.

Technology vendors have responded to these changing tax requirements by developing solutions with varying approaches including automation and the leveraging of enterprise-wide data.

We can work with you to identify, map and transform your tax processes utilising the latest technology developments to automate where it adds value.

Spotlight: Robotic Process Automation (RPA)

RPA can have a significant impact on a Tax organisation as a result of its ability to reduce cost and redirect focus on activities that create value and job satisfaction.

Learn more on our Hong Kong tax technology website.

Have robust and accurate data for the business and tax administrations

Although data is not a new issue for Tax it’s fast turning into one of the major enablers for future state Tax functions. Tax authorities continue to move ever closer to real time data extraction and e-auditing and there has never been a greater need for tax departments to be data literate.

Learn more on our Hong Kong tax technology website.

Unlock data insights to add more value to the business

Unlocking actionable insight from enterprise data can be a challenging problem especially at large volumes and in complex business landscapes. Research suggests that tax functions typically spend more of their time gathering tax data, than on strategic tax analysis, but only 24% of CEOs deem the data they receive in relation to financial forecasts and projects to be “comprehensive"

Learn more on our Hong Kong tax technology website.

How the tax function addresses its need for quality and timely data will ultimately shape its processes and resource requirements, as well as impact its ability to contribute more strategically to the overall business. The tax function must be actively involved in the budgeting of data management and analytic projects similar to those of other functions within the enterprise. It must also participate proactively in enterprise initiatives and cannot be passive in articulating the data issues it faces.

We can help you unlock data insights in your business.

Tax Function of the Future: Unlocking the power of data and analytics

We discuss our predictions around how streamlining the data collection and management process enables the tax function to shift its focus from gathering data to analysis and strategic participation within the organisation.

Align tax with business strategy

Beyond legal requirements, an organisation’s tax strategy must be intrinsically linked to the commercial and overall strategic objectives of the business. Poor tax management and lack of governance can have a negative commercial and reputational impact on the business. This requires a new approach to setting a tax strategy, connecting with wider finance and operational stakeholders to define the role of tax management within the organisation.

We can help you to define your tax strategy while considering the broader debate around tax policy developments to help you respond in the most effective way.