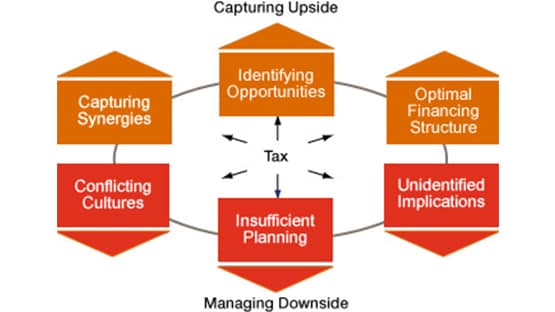

M&A transactions provide unique tax planning opportunities. At the same time, potential tax risks need to be properly managed.

Our M&A tax professionals are organised in industry-specific teams to provide the broad-based knowledge you need in capturing the upside potentials and downside risks in the advent of major M&A transactions.

Our services

Our M&A tax team offer the following services:

- Tax due diligence;

- Tax and financial structuring; and

- Post-transaction services (for example, post-deal integration management and solutions).

Why PricewaterhouseCoopers?

There are a number of reasons you would want to choose PricewaterhouseCoopers as your M&A tax advisors:

- Our global network;

- Integrated delivery system;

- Broad based M&A services;

- Delivery of services throughout all phases of an M&A transaction.

Related content

Contact us

Follow us