Group tax review

The group tax review is a process that is designed to assist you in identifying the key domestic and international tax attributes of your corporate group with a view to reducing potential tax risks and exposures, minimising tax costs and creating value through the development and implementation of relevant tax management solutions. It also helps you in formulating effective strategies for optimising your corporate group's overall tax position.

Typically, operation and ownership structures that have emerged naturally with the development of business rather than planned result in structures that:

- Have high maintenance cost;

- Involve complex operation and documentation flows; and

- Harbour latent tax risks that were acceptable at early growth phase but which may no longer be acceptable today.

By undertaking a group tax review, your corporate group may achieve some or all of the following objectives:

- To optimise the business/holding/tax structures;

- To streamline its operation and documentation flows;

- To revisit tax risks appetite in light of current stage of development of the business and to minimise tax risks and exposures; and

- To explore tax planning opportunities, including the structuring of internal and external funding arrangements.

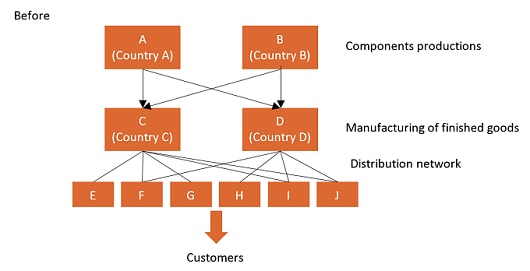

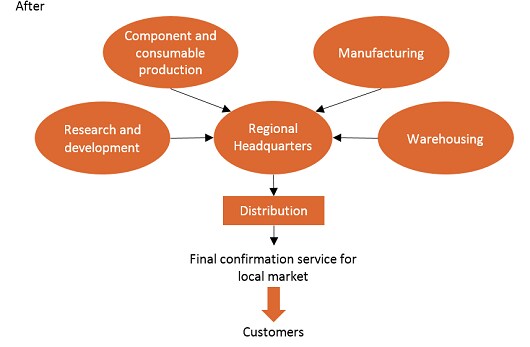

Below is an illustration of a typical operating and business structure before and after conducting a group tax review.

A group tax review could involve the following process:

- Identifying your corporate group's business objectives and needs;

- Understanding your corporate structure and operations;

- Formulating a tax strategy/solution that optimises the group's business objectives;

- Planning the implementation;

- Implementing the restructuring steps; and

- Conducting a post-implementation review.

The group tax review is also an excellent tool for revisiting old tax strategies and deal with exposures when planning for an IPO or creating an efficient tax structure when doing a corporate reorganisation.

Contact us