Non-Fungible Tokens (NFTs): Legal, tax and accounting considerations you need to know

December 2021

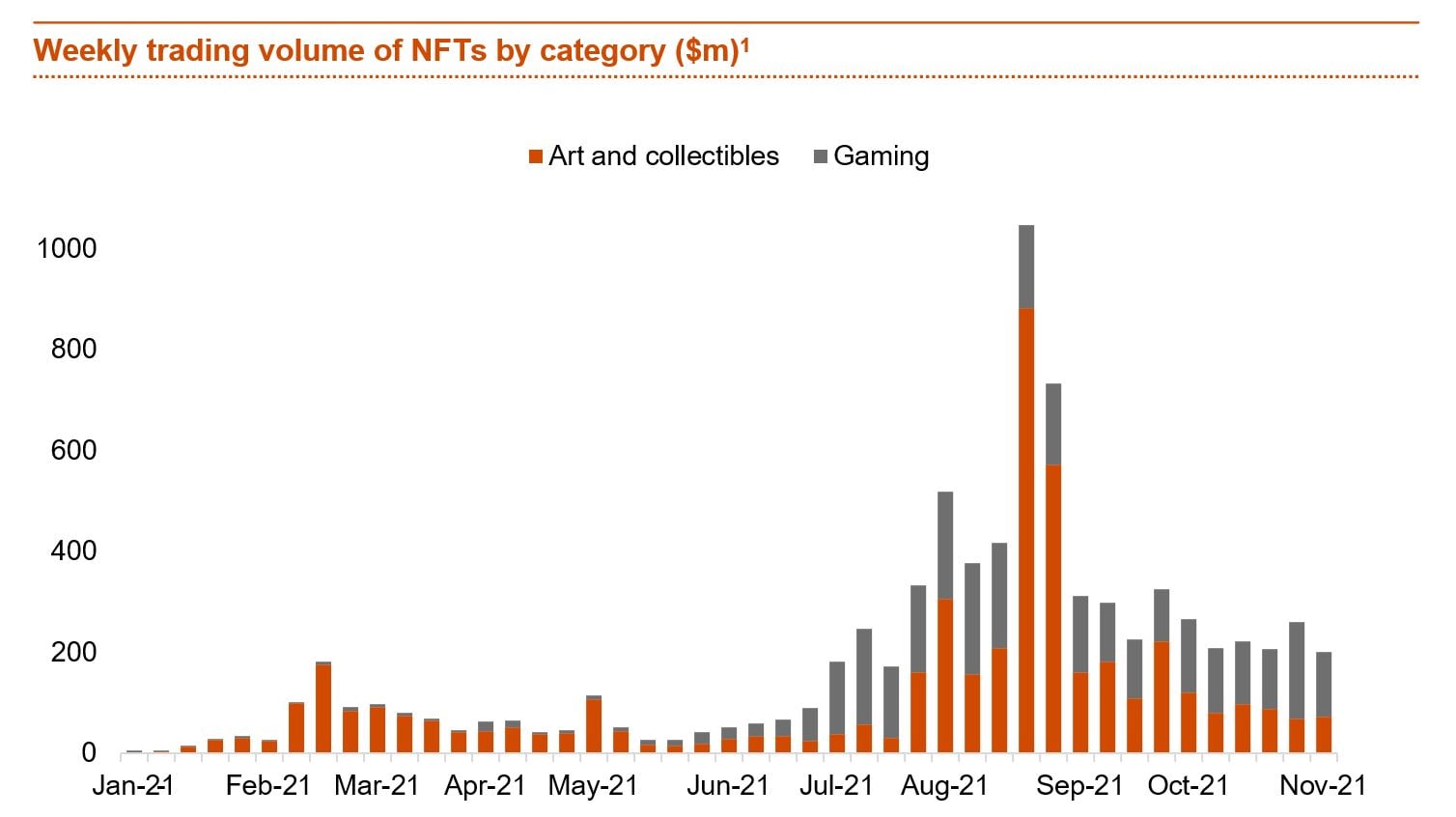

Non-fungible tokens (NFTs) are unique and non-interchangeable digital assets stored on a blockchain. The rise of NFTs this year has surprised people in not only the growth of the ecosystem but also the practical utilities of NFTs. Since early 2021, the market has grown exponentially from US$13.7 million in the first half of 2020, to US$2.5 billion in sales in the first half of this year1.

NFTs are game changing for art, creative contents and how intellectual properties are handled. Much like how cryptocurrencies continue to disrupt the financial markets, by reducing the need for intermediaries or middlemen, and in a similar vein, NFTs are shifting the balance of power from intermediaries to content creators. This powerful shift in the market is only just the beginning but will have a far-reaching impact. Many content creators, artists specifically, are used to being paid on delivery of their content only to watch future buyers of the piece go on to sell it for multiples of the original sale price time and time again. With NFTs that no longer needs to be the case. Through the use of NFTs, because blockchain technology is utilised, royalties can potentially be easily tracked and paid directly to the artist indefinitely. This means that when a piece of art is used commercially the artist would see continued benefits, which is a significant change to the business models for the creative content industries.

With the advent of countless social media platforms and communication tools it is getting easier for people all over the globe to communicate and bond over common interests. As NFTs expand beyond simple collectibles to digitally represent one’s identity online, they are becoming more ingrained in society. One of the largest social media platforms have seen a rise in users putting their NFTs as their profile picture. NFTs are offering the possibility to engage consumers in a new and exciting way.

NFTs offer the ability for the creator of the NFT or brand to connect directly with the consumer, whether it be through special perks or a conversation about the product. They offer traditional business new revenue streams. As we begin to exit the pandemic the shift towards a preference for experiences over material possessions will be further accentuated further promoting the growth of experiential NFTs such as Generative NFTs which are generated through artificial intelligence or algorithms.

The NFT ecosystem

Collectibles

Scarcity is a desired property for any collectible item. The Blockchain immutability and transparency create the uniqueness of virtual or physical objects. The value of collectibles can be readily available to potential buyers if those are traded within a public blockchain environment. An example of an already established NFT collectibles initiative is the NBA Top Shot, a blockchain based platform that allows fans to buy, collect and trade a predefined number of officially licenced video clips of NBA players and other highlights. Less than a year since its launch it has already reached more than US$700 million in total sales and more than 1 million users.

Gaming

When it comes to gaming, NFTs can serve as digital certificates of achievements or ownership of items in the virtual world. This can potentially allow trading of such items through an in-game marketplace or through any form of open market. Cross platform transfer of achievements and game items is also possible if interoperability is allowed between the relevant networks. The most successful games in the market have developed in-game economics. By offering NFTs, game creators could offer a whole set of new possibilities to attract even more players and create profitable economies for both developers and in-game players.

For example, through the application of NFTs for items/ avatars/ skins/ characters released in-game, gamers could eventually see the opportunity to sell these assets on marketplaces after playing and developing them for years. Additionally, those NFTs could outlive the games for which they were created and could be used in the future as collectables rather than items per se.

The combination of blockchain technology and gaming is expected to face exponential growth in the near future.

Physical art

The traditional approach for the proof of authenticity of physical art involves participation of various experts which is often time consuming and costly. Blockchain transparency allows investors to trace transactions of NFTs, associated with a specific piece of art, to the original creator in order to verify ownership. Apart from the obvious benefit to NFT holders of the proof of ownership of an authentic piece of art, tokenisation of such assets can evolve the way that the market functions. For example, smart contracts linked to the NFTs may include clauses with regards to the percentage of royalties that will be paid to the original creator’s account from every transaction, ensuring that artists are treated and compensated fairly.

Sports

Increasingly, sports brands as well as sports teams have started to partner with crypto companies in order to offer their fan base a new way to strengthen their engagement with their favourite athlete and teams. For example, the National Football League has partnered with a NFT related company to issue virtual highlights as NFTs which could be a GIF or video rather than a still photo. Other European football clubs decided to partner with NFT related companies to create football player digital cards, which have varying degrees of rarity. In addition to being just sports collectibles, some of these NFTs are expected to become usable in fantasy games in the future, which provides collectors with further utility.

Additionally, sports companies have also been reportedly investigating the metaverse and possible uses for NFT items. For example, Nike have reportedly been planning to release digital shoes through the metaverse, allowing people to collect digital footwear for their avatar.

Cultural artefacts and history

Certain media outlets started to express their interest towards NFTs. The Economist, the international weekly magazine, has announced a plan to auction off the front cover of its September 18 DeFi edition as an NFT. The South China Morning Post in Hong Kong SAR, published a litepaper in July 2021 presenting a standard for recording accounts of history and historical assets on the blockchain, thereby ensuring immutability and decentralised ownership. The standard, called ARTIFACT, will use NFTs to allow anyone to trade historical moments.

Other non-media related projects such as the Beeple’s Wenew platform aims to place the most celebrated moments in history on the blockchain, allowing collectors to own and pass down NFTs for the most celebrated moments in music, fashion, sports and politics.

Real estate - real world asset representation

The proof of ownership concept through NFT minting can also be applied to assets with physical substance, such as land, buildings and jewellery. This can potentially benefit the liquidity of various assets since the issued tokens can be traded in an open market on a blockchain. In addition to that, the immutability of blockchain records can replace the current centralised and bureaucratic approach followed for the transfer of title deeds or any other form of ownership validation documents from one party to another. Legal ownership of physical assets, identified through NFTs, can also be associated with voting rights with regards to how and for what purpose the physical assets will be used.

NFTs in music / digital art

Content creators of many different crafts are also among the most who can benefit from this new industry. Artists that do not have the possibility to reach a large audience could sell their work as NFTs without being part of an exquisite art exhibit or profitable music label.

Thanks to the versatile application of NFTs, musicians could sell traditional albums, unique bonus tracks or tickets, etc. as NFTs. In these cases, NFTs acted as a certificate of ownership that creators sell to their audience.

When the owner of a piece of art finds a person who is willing to pay the desired price, the NFT is transferred to the buyer. Meanwhile, the funds paid (or a portion thereof) by the buyer of the art piece can go to the creator initially without splitting large portions of the profits with record labels, music agents or other intermediaries. Even if the piece of art is sold after many years, with NFTs a payment can be paid to the original creator of the NFT in perpetuity. Additionally, given that an NFT gives the ability to track the use and ownership of the NFT through its entire lifecycle, it gives the creator the ability to continually engage the owner through the provision of additional content post sale.

Tickets and any form of access authorisation

Any form of evidence that allows holders to access certain events, software, airplane tickets, etc., can be minted and created using unique NFTs. Different functionalities could also be programmed on these types of NFTs. For example, the value of tickets can be programmed to vary in accordance with the demand, ensuring that full capacity is utilised and that event organisers or service providers maximise their gains.

Education and research

Authenticity of educational achievements and degrees are of vital importance not only for the education industry but also for the business and professional world in general. Tokenisation of certificates can prove the authenticity of documents to third parties without the need to contact the issuer. Literary property can also be protected through NFTs improving the value of research activity.

[1] Source: The Block Research, Nov 2021